Why are Personal Loans Considered One of The Best Options to Repay Credit Card Debt?

Personal loans have gained huge popularity in the past few years because the loan amount can be used for any purpose ranging from paying off medical expenses, financing a trip, debt consolidation, and muchmore. Debt consolidation is one of the most popular uses of personal loans. It helps to eliminate multiple monthly high-interest card payments and consolidate the debt into one monthly personal loan payment. Credit cards usually charge high-interest rates between 12% to 24%. On the other hand, personal loans have lower interest rates ranging between 3% to 30%. High-interest rates credit card debts increase the cost of interest rate with time in comparison to the personal loan debt. Therefore, it is considered one of the best ways to repay the debts of credit cards with an instant personal loan.

Benefits of Using a Personal Loan To Repay Credit Card Debts

Applying for an instant personal loan is the best decision if you wish to get out of the debts faster and without any stress. It can help you in the following ways:

Earn a Lower Interest Rate

The average interest rate charged on credit cards is higher than on personal loans. Thus, you can cut off your interest payment with a personal loan and even pay back the amount sooner without overburdening yourself with debt. In simple words, we can say an affordable interest on personal loans is one of the best and most reliable ways rather than using other credit cards.

Consolidation Streamlines Payments

If you are supposed to pay back different credit card amounts every month, then missing out on the loan payments is quite high. If you miss out on any payment, you will have to pay late payment fees, and your credit score will drop. By taking an instant loan to pay off debts, you will have to make only one monthly payment rather than several payments. Therefore, it helps reduce the number of payments, thus helping to free up the time and space for other responsibilities.

Boost Credit Score

Taking a personal loan can positively affect your credit score in several ways. First, availing of an instant loan and repaying on time helps to show the creditors and lenders that you are a responsible borrower. Also, if you pay back the loan in time, your credit utilisation will decrease, which further helps to improve your score.

Borrower May Pay off Debt Sooner

If you pay out minimum credit card payments every month, it can take many years to pay back the loan amount. With a personal loan, you can pay off the debt amount in one go and set a payment plan to pay off the personal loan amount. The terms and conditions and interest rates vary depending on how much you borrow and your preferred tenure. While availing of an instant personal loan, Just be sure you don’t restart the cycle by rebuilding credit card debt.

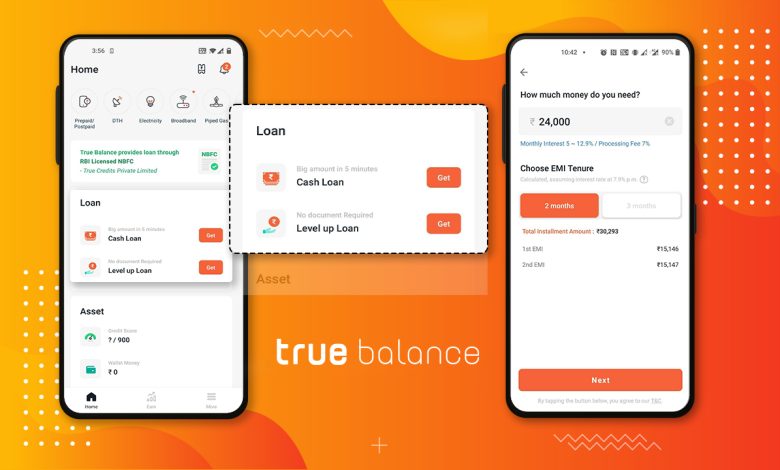

You can apply for an instant personal loan from the online loan apps. However, I would recommend you to try the safest and most reliable loan app registered with RBI, which is TrueBalance. With this online loan app, you as a borrower can avail of a loan of up to INR 50,000 without risking your assets. Also, the interest rate charged by lenders on this app is only 5%, which is quite low compared to other loan apps. You can download the TrueBalance loan app from the Google Play Store for more details.